All Categories

Featured

Table of Contents

The repayment could be spent for development for an extended period of timea single costs deferred annuityor invested momentarily, after which payment beginsa solitary premium instant annuity. Single premium annuities are frequently funded by rollovers or from the sale of a valued property. A versatile costs annuity is an annuity that is intended to be funded by a collection of repayments.

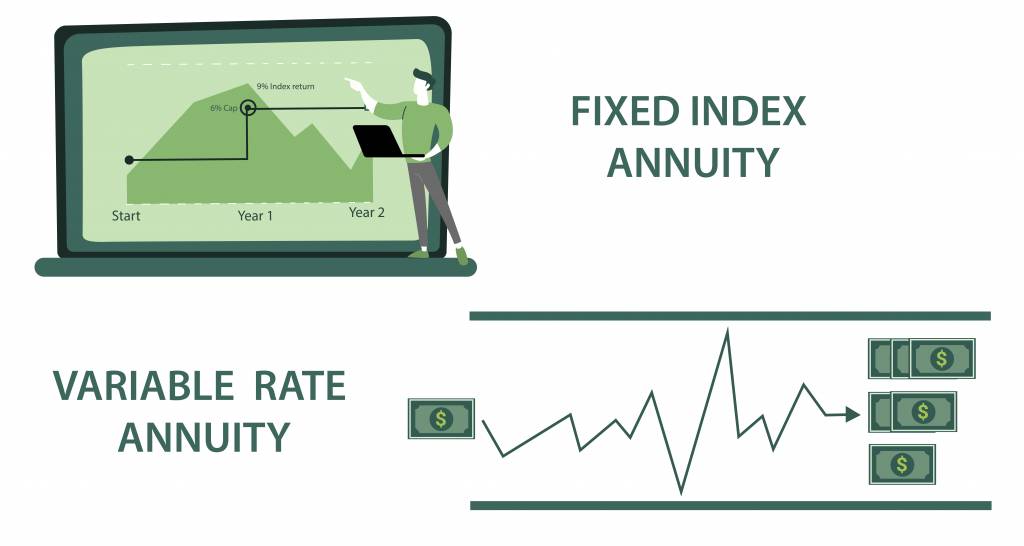

Proprietors of dealt with annuities understand at the time of their purchase what the value of the future capital will certainly be that are created by the annuity. Undoubtedly, the number of capital can not be known ahead of time (as this depends upon the agreement proprietor's life-span), however the assured, taken care of rates of interest at the very least provides the proprietor some level of assurance of future income from the annuity.

While this difference appears simple and uncomplicated, it can significantly influence the worth that a contract owner inevitably stems from his/her annuity, and it develops considerable uncertainty for the contract owner - Annuity payout options. It likewise commonly has a material impact on the level of fees that a contract owner pays to the releasing insurance firm

Set annuities are commonly utilized by older financiers that have actually restricted possessions but who intend to counter the threat of outliving their properties. Set annuities can work as an effective tool for this purpose, though not without certain disadvantages. In the instance of instant annuities, as soon as a contract has actually been acquired, the agreement proprietor relinquishes any kind of and all control over the annuity properties.

Exploring the Basics of Retirement Options Key Insights on Variable Annuities Vs Fixed Annuities What Is the Best Retirement Option? Benefits of Pros And Cons Of Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Immediate Fixed Annuity Vs Variable Annuity Understanding the Rewards of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Choosing Between Fixed Annuity And Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Beginner’s Guide to Variable Vs Fixed Annuities A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

An agreement with a common 10-year abandonment duration would charge a 10% abandonment fee if the agreement was surrendered in the first year, a 9% surrender charge in the second year, and so on up until the abandonment fee reaches 0% in the agreement's 11th year. Some deferred annuity agreements consist of language that enables small withdrawals to be made at different intervals throughout the abandonment period without fine, though these allocations usually come with a price in the kind of lower guaranteed interest prices.

Equally as with a fixed annuity, the proprietor of a variable annuity pays an insurance policy business a lump amount or collection of payments for the promise of a series of future repayments in return. As mentioned over, while a repaired annuity grows at an assured, consistent price, a variable annuity expands at a variable rate that depends upon the performance of the underlying investments, called sub-accounts.

During the accumulation stage, properties bought variable annuity sub-accounts expand on a tax-deferred basis and are exhausted only when the agreement proprietor takes out those earnings from the account. After the accumulation phase comes the earnings phase. In time, variable annuity properties ought to theoretically boost in value up until the contract owner determines she or he wish to start taking out money from the account.

The most considerable issue that variable annuities normally present is high price. Variable annuities have a number of layers of costs and costs that can, in accumulation, develop a drag of up to 3-4% of the contract's value each year.

M&E expenditure fees are determined as a percentage of the contract value Annuity providers pass on recordkeeping and various other administrative costs to the contract proprietor. This can be in the type of a level yearly fee or a portion of the contract worth. Administrative fees might be included as component of the M&E threat fee or might be evaluated independently.

These fees can range from 0.1% for easy funds to 1.5% or even more for actively taken care of funds. Annuity contracts can be tailored in a number of ways to serve the particular demands of the contract owner. Some common variable annuity motorcyclists include guaranteed minimum accumulation benefit (GMAB), assured minimum withdrawal benefit (GMWB), and assured minimal income advantage (GMIB).

Exploring Annuities Variable Vs Fixed Key Insights on Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable Annuities Can Impact Your Future Fixed Vs Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Income Annuity Vs Variable Annuity Who Should Consider Fixed Vs Variable Annuity Pros And Cons? Tips for Choosing the Best Investment Strategy FAQs About Tax Benefits Of Fixed Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Annuities Variable Vs Fixed

Variable annuity payments provide no such tax obligation deduction. Variable annuities often tend to be extremely inefficient cars for passing riches to the next generation since they do not enjoy a cost-basis adjustment when the initial contract owner passes away. When the owner of a taxable investment account passes away, the expense bases of the financial investments held in the account are adapted to reflect the marketplace costs of those financial investments at the time of the proprietor's fatality.

For that reason, beneficiaries can inherit a taxable investment profile with a "clean slate" from a tax point of view. Such is not the situation with variable annuities. Investments held within a variable annuity do not get a cost-basis modification when the original proprietor of the annuity dies. This implies that any kind of built up unrealized gains will certainly be handed down to the annuity proprietor's heirs, together with the connected tax obligation worry.

One substantial issue connected to variable annuities is the possibility for disputes of passion that may feed on the part of annuity salesmen. Unlike a financial expert, who has a fiduciary duty to make investment decisions that benefit the customer, an insurance broker has no such fiduciary obligation. Annuity sales are very profitable for the insurance policy professionals who market them due to high in advance sales compensations.

Numerous variable annuity agreements contain language which positions a cap on the portion of gain that can be experienced by certain sub-accounts. These caps prevent the annuity proprietor from fully taking part in a part of gains that could otherwise be enjoyed in years in which markets generate substantial returns. From an outsider's point of view, it would appear that financiers are trading a cap on investment returns for the aforementioned guaranteed flooring on financial investment returns.

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Variable Vs Fixed Annuity Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Risks of Retirement Income Fixed Vs Variable Annuity Who Should Consider Indexed Annuity Vs Fixed Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Indexed Annuity Vs Market-variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities

As kept in mind over, give up charges can badly limit an annuity owner's ability to move properties out of an annuity in the very early years of the contract. Additionally, while many variable annuities permit agreement proprietors to take out a defined amount throughout the accumulation stage, withdrawals yet amount usually result in a company-imposed cost.

Withdrawals made from a fixed rate of interest investment alternative might also experience a "market worth change" or MVA. An MVA readjusts the value of the withdrawal to mirror any modifications in rates of interest from the moment that the cash was bought the fixed-rate alternative to the moment that it was taken out.

Frequently, even the salesmen who offer them do not fully recognize just how they function, and so salespeople in some cases take advantage of a purchaser's feelings to sell variable annuities rather than the values and viability of the items themselves. Our company believe that capitalists should fully understand what they possess and exactly how much they are paying to have it.

Nevertheless, the very same can not be stated for variable annuity possessions held in fixed-rate investments. These assets lawfully come from the insurance provider and would certainly as a result be at threat if the business were to fail. Similarly, any kind of assurances that the insurance business has accepted give, such as an ensured minimum revenue benefit, would certainly be in concern in the event of an organization failing.

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is Worth Considering Annuity Fixed Vs Variable: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Retirement Income Fixed Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Annuities Fixed Vs Variable

Possible purchasers of variable annuities need to comprehend and consider the economic problem of the providing insurance business before entering right into an annuity contract. While the advantages and downsides of numerous sorts of annuities can be debated, the actual issue bordering annuities is that of suitability. In other words, the question is: that should own a variable annuity? This concern can be challenging to respond to, provided the myriad variations readily available in the variable annuity world, yet there are some standard guidelines that can assist financiers choose whether annuities ought to play a role in their financial strategies.

As the stating goes: "Purchaser beware!" This post is prepared by Pekin Hardy Strauss, Inc. ("Pekin Hardy," dba Pekin Hardy Strauss Riches Management) for educational objectives just and is not planned as a deal or solicitation for company. The information and information in this article does not comprise legal, tax obligation, audit, financial investment, or other expert recommendations.

Table of Contents

Latest Posts

Breaking Down Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Deferred Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Income A

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices Defining Fixed Index Annuity Vs Variable Annuities Features of Smart Investment Choices Why Choosing the Right Finan

Understanding Pros And Cons Of Fixed Annuity And Variable Annuity Key Insights on Fixed Interest Annuity Vs Variable Investment Annuity What Is Immediate Fixed Annuity Vs Variable Annuity? Features of

More

Latest Posts